LIC Jeevan Shiromani Plan Details. LIC, or Life Insurance Corporation of India, is a well-known and reputable insurance company that provides a variety of insurance plans, particularly life insurance plans.

Jeevan Shiromani’s policy offers financial security and coverage for both life and health. One of the best things about this company is that it provides good financial security at a relatively low cost. LIC is a very old company and has been providing insurance services to people for a long time.

The Life Insurance Corporation of India (LIC India) is a very well-known and reputable company in the life insurance business. The company has introduced a plan called LIC Jeevan Shiromani Plan. Through this post, we will provide you with information related to this plan. The company constantly provides new offers to customers to keep them interested.

Highlights of LIC Jeevan Shiromani Plan

| Company Name | Life Insurance Corporation of India |

| Scheme | LIC Jeevan Shiromani Plan |

| Benefits of Scheme | Death, survival, maturity and critical illness benefits |

| Application Process | Online and Offline |

| Official Website | Click here |

What is LIC Jeevan Shiromani Policy 947?

LIC Jeevan Shiromani Policy 947: LIC Jeevan Shiromani Policy (Policy No. 947) is a new money-back plan launched by LIC on December 19, 2017. It is a premium money-back plan from LIC. It is a participating plan with added benefits.

Lic Jeevan Shiromani plan 947 is specifically designed for HNIs (High net-worth Individuals). It is a limited premium paying, with a bonus and non-linked plan which offers a combination of protection and saving features.

This is a life insurance coverage plan, where the policyholder pays regular instalments during the policy term and receives a lump sum amount at maturity. This plan also provides coverage for serious illnesses and offers three optional riders. It also provides coverage for death due to any cause during the policy term.

LIC Jeevan Shiromani Plan Features?

- Minimum Entry Age: 18 years

- Maximum Entry Age: 55 years (for a 14-year policy term), 51 years (for a 16-year policy term), 48 years (for an 18-year policy term), 45 years (for a 20-year policy term)

- Maximum Age at Maturity: 69 years (for a 14-year policy term), 67 years (for a 16-year policy term), 66 years (for an 18-year policy term), 65 years (for a 20-year policy term)

- Minimum Basic Sum Assured: 1 Crore Rupees.

- Maximum Basic Sum Assured: No limit. Increase in Sum Assured in multiples of Rs. 5 lacs.

- Policy Term: The term of this policy is 14, 16, 18, and 20 years

- Premium Payment Term: 4 years less than the policy term. For example, for a 14-year policy term, the premium payment term will be 10 years.

- Guaranteed Addition: 50 Rupees per 1,000 Rupees sum assured for the first five years, 55 Rupees per 1,000 Rupees sum assured from the sixth year till the end of the premium payment term. Note that the money is payable only at the time of maturity (end of policy term).

- This plan also has an inbuilt critical illness cover.

- The policyholder can also opt for a loan against this plan.

- There are also some rebates offered based on the mode of payment and higher sum insured.

- It provides survival benefits at specified durations.

- This offers critical illness benefits by covering 15 diseases.

- It helps to support the family financially in critical situations.

What are the benefits of LIC Jeevan Shiromani?

Death Benefit: If the policyholder passes away during the first five years of the policy, the guaranteed additional sum will be paid along with the death benefit.

If the policyholder passes away after the completion of five years but before the maturity date of the policy, the guaranteed additional sum assured, the basic sum assured, and loyalty additions will be paid.

The death benefit (payout amount) is higher than the sum assured and includes:

- 10 times the annual premium

- 105% of the premiums paid to date

- 125% of the basic sum assured.

Survival Benefit: If the policyholder stays alive throughout the entire policy term and pays all premiums, a certain percentage of the sum assured will be paid. The specific percentage varies based on the policy’s terms and conditions.

- For a 14-year policy term, a 30% payout of the sum assured will be made on the 10th and 12th policy anniversary.

- For a 16-year policy term, a 35% payout of the sum assured will be made on the 12th and 14th policy anniversaries.

- For an 18-year policy term, a 40% payout of the sum assured will be made on each policy anniversary and a 35% payout on the 14th and 16th policy anniversary.

- For a 20-year policy term, a 45% payout of the sum assured will be made on each policy anniversary and a 40% payout on the 16th and 18th policy anniversaries.

Maturity benefit: If the policyholder remains alive throughout the entire policy term and all premiums have been paid correctly, they will receive the guaranteed additional amount and loyalty addition (if any) along with the basic sum assured upon maturity. The basic sum assured upon maturity is as follows:

- For a 14-year policy term, the total sum assured will be paid out at 40%.

- For a 16-year policy term, the total sum assured will be paid out at 30%.

- For an 18-year policy term, the total sum assured will be paid out at 20%.

- For a 20-year policy term, the total sum assured will be paid out at 10%.

Inbuilt Critical Illness: The policyholder will be entitled to the following benefits if he/she is diagnosed with any of the specified critical illnesses and if the policy premium has been paid at the time of diagnosis.

Inbuilt Critical Illness Rider Benefit: A lump sum equal to 10% of the sum assured. This payment will only be made upon approval of the claim.

Option to defer premium payments: The policyholder is given the option to defer premium payments for a period of two years from the date of claim of a critical illness.

Medical Second Opinion: The policyholder can opt for a Medical Second Opinion. This can be availed through available health service providers, internationally or in India, or through various locations with specialized doctors, as per the arrangements made by the insurer.

What are the critical illnesses covered under LIC’s Jeevan Shiromani Plan?

- Open Chest CABG

- Cancer

- Brain Tumour

- Third degree burns

- Primary pulmonary hypertension

- Open heart replacement or heart valve repair

- Alzheimer

- Blindness

- Aortic surgery

- Multiple sclerosis with continuous symptoms

- Heart stroke

- Limbs Paralysis

- Main organ or bone marrow transplant

- Kidney failure

- Myocardial infarction

Read more: Oriental Insurance Company Limited: Benefits and How to Get Policy

What are the Eligibility Criteria for LIC Jeevan Shiromani policy

You have to fulfil these qualifications to apply for the Jeevan Shiromani plan.

- Age: Minimum 18 years and maximum 55 years at the time of policy inception.

- Policy Tenure: 14, 16, 18, and 20 years.

- Premium Payment Term: 4 years for the policy tenure.

- Modes for Premium Payment: Monthly, quarterly, semi-annually, and annually.

- Sum Assured: Minimum of INR 1 crore and no maximum limit.

- Maturity Age of Policy: Minimum 18 years and maximum 69 years.

Which Documents are required for LIC Jeevan Shiromani Policy

The following standard documents are required to purchase the LIC Jeevan Shiromani policy:

- ID proof

- Aadhar Card

- Birth date proof

- Residency proof

- Recent passport-size photographs

- Bank account details

Premium Structure of LIC Jeevan Shiromani

- The duration of premium payment or premium payment term for policy no. 947 will be 4 years less than the policy term. Let’s say, you have a policy of 14 years, then the premium payment duration will be 10 years. Similarly, for the policy of 16 years, the premium payment term will be 12 years.

- The premium of the policy can be paid monthly, quarterly, semi-annually, and annually.

- For a monthly payment of policy, only NACH and salary deductions are allowed.

We have shared below the illustrated annualised premium amount for the life assured with the age of 20 years and for Rs. 1 crore BSA.

| Policy Term | Premium Payment Term | Total Premium Amount |

| 14 years | 10 years | Rs. 10, 69, 670 |

| 16 years | 12 years | Rs. 8,96,700 |

| 18 years | 14 years | Rs. 7,70,770 |

| 20 years | 16 years | Rs. 6,83,550 |

Which Loan facility available in LIC Jeevan Shiromani policy

According to the surrender value percentage, the maximum loan amount will be 90% for effective policies and 80% for paid-up policies. If there is any outstanding loan amount or interest, it will be cleared through the maturity benefit or claim amount.

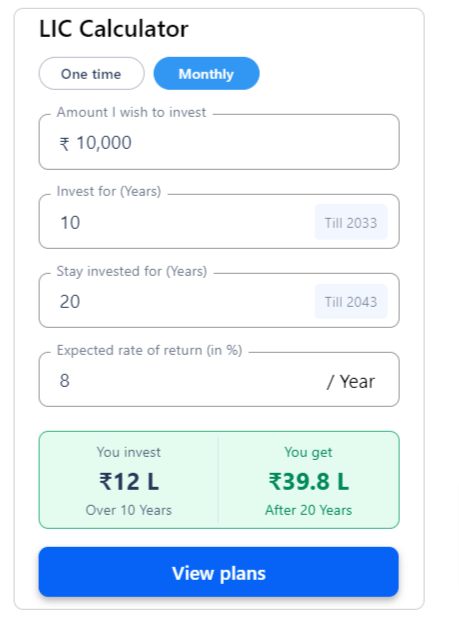

LIC Life Benefit Premium Calculator

The LIC Life Benefit premium calculator helps you calculate the premium and maturity amount for LIC Life Benefits plan 836. Before purchasing the life benefit policy, you will need to check the premium rates for your desired coverage amount by using this.

LIC life benefit calculator or LIC maturity calculator. The use of both the premium calculator and maturity calculator is necessary to determine the premium rates for the life benefit plan.

- Name.

- Email ID.

- Mobile Number.

- Age.

- Policy Tenure.

- Ensured Amount.

If you liked the information provided about the LIC Jeevan Shiromani Plan or learned something new, please share this post on social networks such as Facebook, Twitter, and other social media sites.

Exclusions for LIC Policy No. 947

Before applying for LIC Jeevan Shiromani Policy, you have to check the list of exclusions. It is because there are some points where the claim may be rejected.

- Death caused to the assured because of any listed critical illness.

- Diagnosis of Critical illness in 90 days of risk commencement.

- The survival period for the assured is 30 days from the critical illness diagnosis date.

- The medical condition increased due to war and hospitalities.

- Self attempted injury or suicide.

- Any medical condition which exists before for the assured.

- Any amount of cost for the treatment for HIV, AIDS, or other disabilities.

- Any medical condition happens by the consumption of alcohol and other bad substances.

- Radioactive radiation exposure by nuclear accident.

- When the insured don’t undergo the treatment advised by the doctor.

The Banking Guides Official Social Media

| Click here | |

| Click here | |

| Click here | |

| Click here | |

| Quora | Click here |

| Official website | Click here |

Conclusion

In conclusion, LIC Jeevan Shiromani Plan is a comprehensive life insurance policy that offers a range of benefits to policyholders. The plan provides financial security to the policyholder’s family in the event of their untimely demise, as well as maturity benefits if the policyholder survives the policy term.

The plan also offers the option of taking a loan against the policy, subject to the terms and conditions of the policy and the insurer. The eligibility criteria and required documents for purchasing the policy are straightforward, making it easy for individuals to apply for coverage. Overall, the LIC Jeevan Shiromani Plan is a reliable and suitable option for those looking for a comprehensive life insurance policy.

People Also Ask

What is the maximum age limit for purchasing the LIC Jeevan Shiromani Plan?

The maximum age limit for purchasing the LIC Jeevan Shiromani Plan is 55 years.

How long is the policy term for the LIC Jeevan Shiromani Plan?

The policy term for the LIC Jeevan Shiromani Plan is 15 years.

What is the minimum sum assured for the LIC Jeevan Shiromani Plan?

The minimum sum assured for the LIC Jeevan Shiromani Plan is Rs. 2,00,000.

Is there an option for taking a loan against the LIC Jeevan Shiromani Plan?

Yes, the LIC Jeevan Shiromani Plan offers the option of taking a loan against the policy, subject to the terms and conditions of the policy and the insurer.

Are there any riders available for the LIC Jeevan Shiromani Plan?

Yes, there are riders available for the LIC Jeevan Shiromani Plan that provide additional coverage and benefits. These riders can be added to the policy at an additional cost and are subject to the terms and conditions of the policy and the insurer.

Note: Friends, we bring here the information about the scheme of the Central and State government for you. So, you can save this website thebankingguides.com in your bookmarks. By clicking the link from above, you can connect to our all social media platforms.

If you like this article then share it with your friends and family.

Thanks for reading this article till the end.

3 thoughts on “LIC Jeevan Shiromani Plan: Features, Eligibility, & Benefits”

Comments are closed.