Build credit while saving with unlimited cash back at gas stations, grocery stores, and drugstores! Ollo Card offers one of the few cards without an annual fee, foreign transaction fee, or penalty APR when payments are missed – unlike many others!

The Ollo Card is only available by invitation and requires an acceptable credit score to qualify. Furthermore, Ollo has provided secure website hosting services and live customer support.

ollo card login Unlimited 2% cash back

The Ollo card offers unlimited 2% cash back on gas, grocery, and drugstore purchases without charging an annual fee or foreign transaction fees – making it one of the best credit cards for people with fair credit scores. Furthermore, its excellent customer service team is available around-the-clock should any questions arise or issues need addressing.

This card provides consumers with an opportunity to build or rebuild their credit while earning cash-back rewards. Available by invitation only and not featuring signup bonuses or an APR introductory rate, it works at all merchants that accept Mastercard payments while not requiring security deposits like secured credit cards do.

Ollo was established by experienced executives of Fair Square, an organization dedicated to leveling the playing field for consumers with poor credit. Ollo utilizes its proprietary approach for credit card approval in order to evaluate risk and offer products best suited to individual consumers. Since its creation, this venture has raised $200 million from financial services-focused private equity firm Pine Brook and received funding from Delaware state grants.

Ollo Rewards Mastercard is an ideal credit card for building or repairing credit. It features numerous benefits, such as free credit reports, unlimited 2% cash back at gas stations, grocery stores, and drugstore purchases with no annual fee, returned payment/over-limit fees, or foreign transaction fees; an ideal option for those with near-prime credit scores looking for regular rewards rather than secured cards.

This card also comes equipped with a mobile app to help you keep an eye on spending and payments, and manage your account online whenever it suits you. Simply log in with your user ID and password, view recent transactions, check your balance, and make payments as needed – anytime!

READ MORE:-Ollo Credit Card Login Review

Ollo Platinum card details and benefits

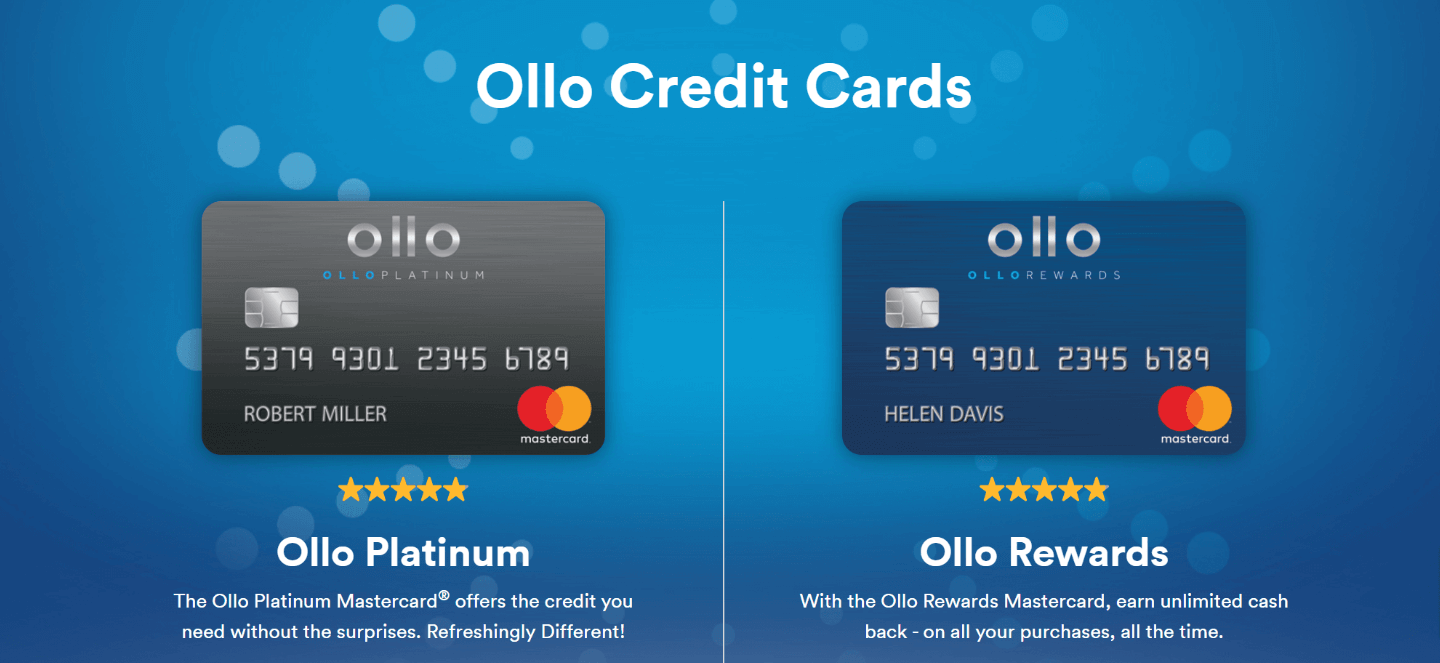

The Ollo Platinum Mastercard, Ollo’s entry-level product, is for those who have good or fair credit.

While it’s not able to offer spending rewards, the Platinum’s simple fee structure grants it an edge over other credit-building cards. There’s no annual charge, and there’s no returned fee for payments and there’s no fee for exceeding limits. It doesn’t charge foreign transactions fees either, which makes it an excellent option for frequent travellers or online shoppers who have an affinity for international stores.

The costs that Ollo Platinum does carry – for late payment, balance transfer and the cash advance – can be relatively easy to avoid. If you do not pay on time and you don’t pay, you’ll be charged $28 for the first time and then $40 for each subsequent slip-ups within the six billing cycles according to the Ollo cardmember’s contract.

In addition, while late payments don’t result in penalties however, Ollo Platinum card’s variable APR is already at a high level. Ollo Platinum card’s variable APR is currently between 24.99 percent and 27.99 percent (nearly nine percentage point more than the typical credit card rate of 16.26 percent).

ollo card sign in

Ollo’s product lineup includes the Ollo Platinum Mastercard, Ollo Rewards Mastercard and Ollo Optimum Mastercard. All three are serviced by Ollo Card Services and issued by the Bank of Missouri. Here’s an at-a-glance look at the features and benefits of each:

| Ollo Platinum Mastercard | Ollo Rewards Mastercard | Ollo Optimum Mastercard |

| Rewards rate N/A | Rewards rate 2% cash back at gas stations, grocery stores and drugstores; 1% back on all other purchases | Rewards rate 2.5% cash back on all purchases |

| Intro offer N/A | Intro offer N/A | Intro offer 0% intro APR on new purchases and balance transfers for 15 months (targeted) |

| Other notable features Automatic account reviews for credit line increases, free FICO score, zero fraud liability, 24/7 customer service, credit education resources | Other notable features Rewards don’t expire, no minimum required to redeem, free FICO score, zero fraud liability, 24/7 customer service, credit education resources | Other notable features Rewards don’t expire, no minimum required to redeem, instant “Lock It” tool if you misplace your card, free FICO score, zero fraud liability, 24/7 customer service, credit education resources |

Ollo Card No annual fee

Ollo Credit Cards stands out from other credit card companies by not charging annual or other hidden charges, making their cards easier to manage and use. Plus, their no-fee credit limit increase policy rewards customers who make timely payments with more flexibility in managing and increasing credit limits – more information on this card can be found via their online portal or by calling customer service for the company.

Ollo is a new card issuer that specializes in offering credit cards to individuals with fair or poor credit scores, founded by former executives from Bank of America and Capital One. Ollo currently offers two credit cards – The Platinum Card and the Rewards Card – but you must first receive an invitation to apply from them.

Prequalify for an Ollo Platinum Card by providing some personal details, such as your Social Security number, address, and income. In order to determine eligibility and prequalify you will also have to undergo a soft credit inquiry which runs a soft inquiry soft. Once this inquiry has completed and meets its minimum score threshold you will be notified and can proceed with your application process.

Once approved, an Ollo Platinum Mastercard can be used for almost any purchase imaginable; however, keep in mind that your credit line will depend on factors like payment history. If you want to improve your credit, aim not to pay more than 30-35% of your limit each month and always pay your monthly balance promptly.

Ollo Platinum Mastercard offers an ideal way to establish or improve your credit. There’s no annual fee and cash back on purchases at gas stations, drugstores, and grocery stores; plus no foreign transaction fee and zero fraud liability liability! Plus its user-friendly website and mobile app make managing your account simple.

While this card may be an ideal solution for many consumers, some have reported their credit limits being reduced without notice or their variable interest rate increasing over the course of one year. If you want a better option when building credit, consider more established card issuers – for instance, Milestone Gold Mastercard and OpenSky Secured Visa may both provide viable alternatives for those with poor credit.

Pros and cons of Ollo cards

Though Ollo cards offer useful benefits for cardholders, they certainly have some drawbacks. Highlighted below are both the pros and cons of owning an Ollo credit card.

Pros

- Automatic credit line reviews – accounts are automatically reviewed after six months, with the possibility of a credit line increase

- No penalty APR

- Requires only fair or good credit score

Cons

- Higher than average variable APR (between 24.99% and 27.99%)

- Invitation only – must receive prescreened offer to apply

- Statement credits only rewards redemption option

No foreign transaction fees In Ollo Card

Ollo Card may be just the ticket if you want to improve your score quickly. Designed specifically with beginners in mind, this card doesn’t charge annual, over-the-limit, or foreign transaction fees, as well as returned payment or late fee charges. Furthermore, monthly FICO scores will be made available and can even be used online to pay bills fast! To register an Ollo Card account simply visit their official website and click “Enroll Here”, providing your personal data while agreeing to the terms and conditions of the Ollo card login account login account registration account creation process.

Fair Square Financial’s inaugural product is the Ollo Card from Wilmington-based Fair Square Financial, which offers credit cards to consumers with diverse credit profiles. Their founders saw that many consumers who apply for cards each day but are rejected due to poor or no credit were being denied approval; as a way of leveling the playing field and offering competitive rates without hidden surprises, they founded Fair Square Financial to create equality of access with credit cards at competitive rates and without surprises attached.

One of the primary advantages of this credit card is that it does not charge foreign transaction fees, making it a great option for travelers who often incur expensive premiums when making international purchases. Furthermore, no over-the-limit or returned payment fees apply, making this card suitable for people on a tight income budget. Furthermore, its excellent fraud protection and 24/7 customer service make it safe to carry while traveling abroad.

Ollo credit card stands out by not charging an annual fee; instead, its Rewards card offers variable pricing depending on usage. Furthermore, Ollo offers other features, including zero fraud liability protection and US-based customer support services.

Ollo credit cards provide another key advantage: helping to build credit over time if payments are made on time and don’t go beyond your limit. In addition, after six months of on-time payments you can receive an automatic increase to your limit; check your account status online anytime from anywhere; and make payments without leaving home!

READ MORE:-Destiny Credit Card Review

24/7 customer service

When choosing a credit card with excellent customer service, look for one with an intuitive online account management system that lets you monitor your balance, make payments, and more any time of day–even while on the move! Customer support may also be accessible via phone call, email, or live chat if necessary.

No matter whether it’s your first credit card experience or simply need assistance with an existing Ollo credit card, their customer service team is available 24-7 and happy to provide assistance. Their knowledgeable and helpful team is always willing to answer your queries and ensure a positive encounter with Ollo credit cards.

For an Ollo credit card application, simply visit their website and complete an application form. When your form has been processed, your new credit card should arrive between 7-10 days in the mail.

Ally Bank offers the Ollo credit card as a Mastercard issued with zero fees or annual fees, offering consumers and businesses alike financial services and banking products at affordable rates. Benefits of this credit card include zero annual fees and zero APR on purchases for nine months – perfect for everyday purchases as well as businesses!

Ollo was established in Delaware in 2016 to address underserved consumers by providing credit cards with low rates and no surprises. Their experienced executives recognized that thousands of individuals each day are rejected from credit cards due to poor or no credit, so the Ollo card was created as an alternative solution that gives people another opportunity to build their credit profile.

Ollo differs from most credit card issuers by not offering checking or savings accounts, instead specializing in offering credit cards to consumers with acceptable credit scores. They do this by purchasing large batches of consumer data and performing soft pulls to identify those with acceptable scores; once identified they send invitations to apply for one of two cards offered: Ollo Platinum and Ollo Rewards Cards based on those criteria.

What is the Ollo Card?

The Ollo Card is a credit card designed for individuals with fair credit scores, offering cashback rewards and credit-building opportunities.

What are the key features of the Ollo Card?

The Ollo Card features unlimited 2% cashback on gas, grocery, and drugstore purchases, no annual fee, and no foreign transaction fees.

How can I apply for the Ollo Card?

To apply for the Ollo Card, you typically need to receive an invitation from Ollo. You can prequalify by providing your personal details and undergoing a soft credit inquiry.

How does the Ollo Card help improve my credit score?

Making on-time payments and managing your credit responsibly with the Ollo Card can positively impact your credit score over time.

Is the Ollo Card affiliated with Ally Bank?

Yes, Ally Bank offers the Ollo Card as a Mastercard with no annual fees and other benefits.

What sets the Ollo Card apart from other credit cards for fair credit?

The Ollo Card stands out with its cashback rewards, no annual fee, no foreign transaction fees, and 24/7 customer support.

Are there any downsides to the Ollo Card?

Some cardholders have reported credit limit reductions or variable interest rate increases, so it’s important to manage your credit responsibly.

Can I access my Ollo Card account online?

Yes, the Ollo Card offers a user-friendly website and a mobile app for convenient account management.

What is the mission of Ollo Card?

Ollo Card aims to provide access to credit for individuals with fair credit scores, leveling the playing field and offering competitive rates.

Is the Ollo Card a suitable choice for international travel?

Yes, the Ollo Card does not charge foreign transaction fees, making it a good option for travelers who make international purchases.