If you’re seeking to improve or rebuild your credit history, Ollo Platinum could be an ideal way to do it. Unfortunately, however, some users have reported their credit limits decreasing without notice and that the card carries high APR rates.

Ollo Credit Card, the consumer Mastercard issued by Wilmington-based Fair Square Financial, has attracted over half a million people since its debut. Thanks to their experienced leadership and innovative fintech mindset.

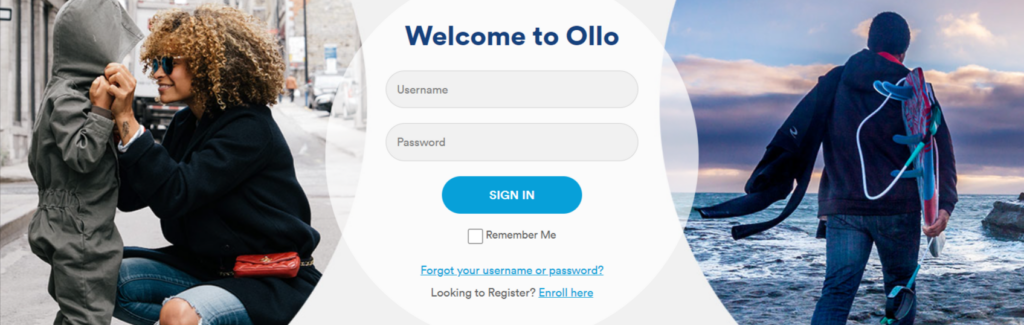

Ollo Credit Card login

Ollo Credit Card login is a digital portal designed to put account management directly in the hands of cardholders. Users have 24/7 access, enabling them to track spending, check balances, and make payments as needed – plus get help from customer support if any problems arise.

Ollo cards offer online account management as well as reporting to all three major credit bureaus, helping borrowers build their credit scores. Furthermore, Ollo provides several additional advantages, such as zero annual fees and no hidden charges; flexible credit limit increases are offered as a reward to cardholders who make timely payments on time.

Log into your Ollo Credit Card by visiting their website, entering in your user ID and password, then clicking “Sign In.” If you’ve forgotten your password, follow these instructions to reset it online. Furthermore, this credit card offers online account access as well as one-time or recurring payments backed by Ally Financial and issued through the Bank of Missouri under a license by MasterCard.

READ MORE:-Destiny Credit Card Review

Ollo Credit Card sign-in

Ollo cardholders should keep in mind the payment methods available to them when making their account payments. These payment options tend to be straightforward and provide easy account management solutions. If any difficulties arise when making payments, don’t hesitate to contact customer service for help – they may arrange alternative payment plans or offer other forms of support as necessary.

Ollo Credit Card Login Portal is an essential tool for online account management, offering 24/7 access and balance monitoring capabilities as well as making it simple for you to avoid fees or charges that might occur on your card.

Start by visiting the Ollo Card website and selecting “Getting Started.” Provide your information as directed in order to register your Ollo card, including providing your name, address, phone number, and social security number as well as providing your Ollo card number and expiration date. After all your required data has been entered you will be asked to accept and agree upon its Terms & Conditions before accepting Ollo Credit Card terms & Conditions.

Ollo Credit Card reviews

If you have fair credit and want a card to help build or rebuild it, consider the Ollo Platinum Mastercard. This unsecured card reports to all three major credit bureaus and offers automatic reviews for limit increases as well as no foreign transaction fees, over-limit fees, or annual fees.

Access your Ollo card account anytime through its website and stay informed about your credit balance and account activity – helping you ensure payments are made on time! Furthermore, reporting unauthorized transactions is simple with Ollo and has a zero fraud liability policy!

Ollo Card eligibility requires having both an excellent credit score and a stable income. Ollo will conduct a soft credit check before inviting you to apply for their card online through their website, where an application form awaits completion with general financial data such as your Social Security number, address, and annual income information.

Ollo Credit Card services

Ollo card services provide an innovative approach to credit building. Their invitation-only model makes applying for a card easy, offering zero annual fees or rewards cards, with no foreign transaction fees and other perks that help get your score back on track.

Ollo Card is one of the best cards available for rebuilding credit, featuring no annual fee and automatically increasing credit limits every five months if payments are timely manner. Plus, they provide a mobile app so managing your account is simpler.

However, some users have reported their credit limits decreased unexpectedly. This may be the result of either carrying an outstanding balance or engaging in fraudulent activities that violate Ollo’s terms and conditions; so it is advisable that users review these periodically in their accounts with Ollo.

Ollo Credit Card payment

Ollo Credit Card Login offers a safe and straightforward online payment option. Furthermore, this company does not charge annual or hidden charges and penalties are minimal for late payments. Furthermore, its cards come with credit limits determined by Ollo, with this number determined depending upon your history as a cardholder; your account can only be closed by Ollo if they breach its Terms and Conditions.

Ollo Credit Cards from the Bank of Missouri offer two standard options that make them among the best-unsecured cards for fair credit consumers with credit scores between 640 and 679. Furthermore, these cards do not require deposits but report to credit bureaus; additionally they allow an increase to your credit line after six months of on-time payments.

To pay your Ollo card, visit their website and enter your username and password. Alternatively, the mobile app provides easy access to balance updates as well as bank statements. If you need assistance from one of their agents please reach out!

Ollo Credit Card apply

Ollo Card is an outstanding credit-building card that does not charge annual fees and imposes low penalties, offering cash-back rewards on purchases as you build your score and save money at the same time. Their user-friendly website makes setting up their card easy; making this option ideal for people trying to rebuild or recover from bankruptcy.

If you’re interested in applying for an Ollo card, follow their website instructions. Among other pieces of data required is your name, birthdate, and Social Security number; once submitted your card will arrive in 7-10 business days!

Ollo does not disclose its minimum credit score requirement, however, a fair credit score would likely increase your chances of approval. Cards issued by Mid America Bank, a subsidiary of Friendship Bancshares Inc., automatically increase after five consecutive on-time payments have been completed on time.

READ MORE:-Mastering Mission Lane Login: A Comprehensive Guide

Ollo Credit Card login to my account

Ollo Card Login is an online portal designed to put credit card account management directly in cardholders’ hands. Users can utilize this tool to keep tabs on their balance and make payments whenever is convenient – this service is always accessible 24/7 and helps simplify financial management.

The Ollo Card stands out from other credit cards by not charging any annual or hidden fees, reasonable late fees, and offering a mobile app for easy account management on the go. Touch ID or Face ID security adds an extra layer of protection and convenience when accessing your account remotely.

To start using your Ollocard, click the “Get Started” button on their website. Here, you will need to provide some basic details, including your name, date of birth, social security number (SSN), and last four digits as well as agree to their terms and conditions before entering a 16-digit Ollocard number with its expiration date and your username/password combination. Once complete you will be taken directly through to setting your login and password information.

Ollo Credit Card customer service

If you own an O card, use it online to track transactions. As well as this feature, you can check your balance, view statements, and make payments – plus contact customer service should any issues arise. To start using it yourself, follow these instructions to sign into your account on their website.

Once signed in, you have 24/7 access to your credit card account and payment management features, with a user ID and password login as the means of entry. Should you forget your password you can also reset it here as well as many other features including 24/7 account access and payment management.

If you’re tired of being nickel and dimed by credit card companies, Ollo may be the solution for you. With no annual fees or high penalty APRs to worry about and 2% cash back on gas and grocery purchases (plus free monthly credit limit increases if payments are timely manner!), as well as mobile apps to make life simpler – this may just be what’s needed!

Q1: What is the Ollo Platinum Mastercard?

The Ollo Platinum Mastercard is a credit card designed for individuals looking to improve or rebuild their credit. It offers features like 24/7 account access, reporting to major credit bureaus, and flexible credit limit increases.

Q2: How can I log in to my Ollo credit card account?

To log in to your Ollo credit card account, visit the Ollo Card website, enter your user ID and password, and click “Sign In.”

Q3: Are there annual fees for the Ollo credit card?

No, the Ollo credit card does not have annual fees.

Q4: Can I use the Ollo credit card for international purchases?

Yes, you can use the Ollo credit card for international purchases, but it may come with foreign transaction fees.

Q5: How do I apply for an Ollo credit card?

To apply for an Ollo credit card, visit their website, provide the required information, and complete the application form.

Q6: Does the Ollo credit card have a minimum credit score requirement?

Ollo does not disclose a specific minimum credit score requirement, but it is designed for individuals with fair credit.

Q7: How often does the credit limit increase with the Ollo credit card?

The credit limit can increase automatically every five months if you make timely payments.

Q8: What should I do if I forget my Ollo credit card password?

If you forget your password, you can follow the instructions on the Ollo Card website to reset it.

Q9: Is the Ollo Platinum Mastercard a good choice for rebuilding credit?

Yes, the Ollo Platinum Mastercard is a good choice for rebuilding credit as it reports to major credit bureaus and offers credit limit increases.

Q10: Are there any drawbacks to the Ollo credit card?

Some users have reported that their credit limits decreased unexpectedly, which may be due to carrying an outstanding balance or violating Ollo’s terms and conditions.