Ollo Credit Card Login: Fed up with hidden fees from your credit card provider? Ollo stands out as a credit card company that rejects the nickel-and-diming approach. Say goodbye to concealed charges and rest assured that you’ll only pay what’s necessary.

Forget about annual fees and steep penalties for late payments—Ollo takes a different approach. Not only are there no annual fees, but maintaining a positive account standing can lead to an increase in your credit limit!

Take control of your account effortlessly through Ollo’s user-friendly online account access and mobile app. Let’s explore the seamless process of setting up your Ollo credit card login online.

About Ollo Credit Card

Ollo credit cards, including the Ollo Platinum Mastercard® and Ollo credit card login Rewards Mastercard®, are issued by the Ollo organization through the banking institutions affiliated with the Bank of Missouri. This option is particularly appealing for individuals seeking favorable terms when accessing credit funds.

Upon receiving the card, detailed instructions accompany it, guiding the recipient through the registration process within their personal account to seamlessly access the user account.

With account access, users unlock a range of functionalities, from receiving payment notifications and transaction reports to setting up auto payments and crafting personalized bill payment plans.

This article will walk you through the step-by-step process of registering in the personal account of an Ollo credit card holder. Additionally, we’ll provide valuable information about the support service and the billing address for your convenience.

Unveiling the Perks: Benefits of the Ollo Credit Card

- Fee Freedom: Ollo Platinum cards boast zero annual fees and absolutely no hidden charges.

- Elevated Limits: Your credit limit adjusts based on your account status—whether it’s in good or bad standing.

- Global Transactions, Zero Fees: Send payments worldwide without incurring any fees on foreign transactions.

- Painless Penalties: Say goodbye to excessive late fees and penalties, applicable to both Platinum and Rewards cards.

- Mobile Mastery: With the Ollo mobile app, effortlessly manage your account, check statements, make payments, and access your FICO score at no cost.

- Web Wisdom: Access your FICO score for free online, safeguarding against default.

- APR Awareness: While the APR can be up to 24%, new users enjoy enticing discount offers.

- Rewarding Returns: Ollo Rewards Card users receive a 2% cashback on grocery, gas, and drugstore purchases.

- Support Around the Clock: Count on reliable and helpful customer service available 24/7 throughout the week.

Convenience of Online Account Management

As an existing Ollo credit cardholder, enjoy the flexibility of accessing your account online around the clock. Just log in using your user ID and password to effortlessly review your account balance, track your payment history, and access additional account details anytime, anywhere.

How to Register for Ollo Credit Card

To gain access to your account and unlock the array of online features, registering on the Ollo credit card login site is essential. Upon registration, each user is provided with a unique username and password for seamless login.

Here’s a straightforward guide on how to register on the portal:

- Visit the Service Website:

Begin by navigating to the official service website. - Initiate Registration:

Locate the blue “SIGN IN” button in the top right corner of the page and click on it to kickstart the registration process. - Enroll Here:

As registration is the goal, click on the “Enroll here” line. - Provide Personal Information:

The service will prompt you to enter personal data, including Last Name, Last 4 digits of SSN, Date of Birth, Ollo Card Number, and Card Expiration Date. Fill in all the required fields. - Receive Username and Password:

Upon successful registration, you will be assigned a unique Username and Password. Use these credentials for future logins. - Access Your Personal Account:

To enter your personal account, click on the “SIGN IN” button on the main page of the site.

Ollo Credit Card Login Process

Navigating Ollo Credit Card Login: A Step-by-Step Guide

Step 1: Open the Official Ollo Card Account Web Portal

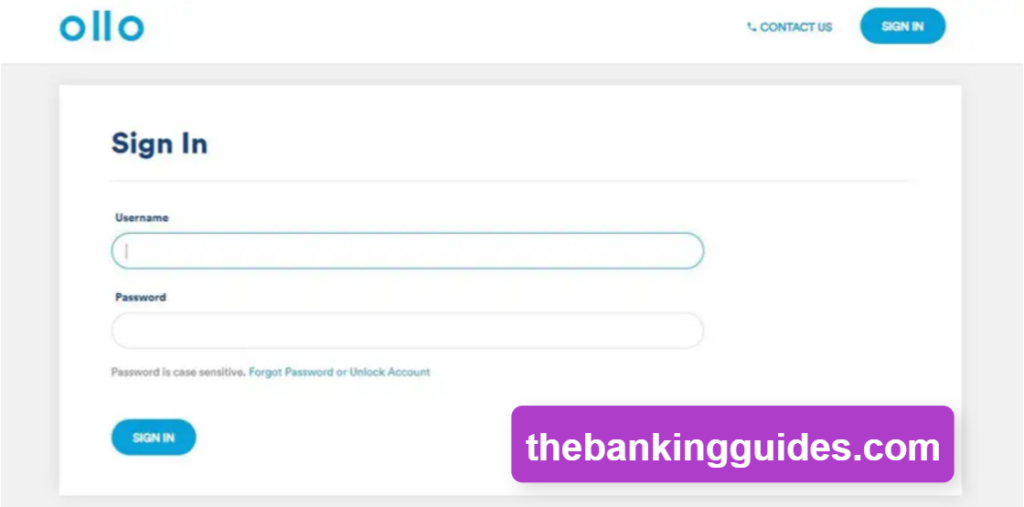

- Begin by accessing the official Ollo Card account web portal at https://www.ollocard.com/. This will lead you to the Ollo Credit Card login page.

Step 2: Locate the Login Form

- If the login form is not visible on the homepage, proceed to the Ollo credit card login page by clicking the “Sign In” link situated at the top right corner.

Step 3: Access the Login Form

- Once on the designated login page, a login form will be prominently displayed.

Step 4: Input Your Credentials

- Enter your designated Username and Password in the provided login form. Optionally, select the “Remember Me” checkbox if you prefer not to type your username every time you access your account.

Step 5: Complete the Login

- Conclude the process by clicking the “Sign In” button.

How to Reset Your Ollo Credit Card Login Password

Step 1: Open the Login Page

- Begin by navigating to the login page, following the same steps as in the last login attempt.

Step 2: Access Password Recovery

- If you encounter issues due to an incorrect password, click on the “Forgot your username or password?” link situated below the login form.

Step 3: Password Recovery Form

- You will be redirected to a password recovery form on the subsequent page.

Step 4: Enter Account Details

- In the provided form, input the last 6 digits of your account number and your username. Subsequently, click the “Next” button.

Step 5: Reset Your Password

- Proceed to the next step, where you’ll have the option to reset your password. Follow the provided instructions to complete the process and establish a new password for your online account.

Ollo Credit Card Payment Options

Convenient Payment Options for Your Ollo Platinum Mastercard

Paying your Ollo Platinum Mastercard is hassle-free with multiple options available, including online, over the phone, through the Ollo mobile app, or via mail.

1. Online Payment:

- Log in to your online account and navigate to the “Make a Payment” section. Follow the prompts to complete your payment securely.

2. Phone Payment:

- Dial (877) 494-0020 or the number on the back of your card. Enter your card information as prompted to make a payment over the phone.

3. Mobile App Payment:

- Utilize the Ollo mobile app, compatible with iOS and Android. Log in to your account, select your card, and tap on “Make a Payment” to conveniently pay your Ollo Platinum Mastercard®.

4. Mail Payment:

- For payments by mail, send a check or money order (do not send cash) to the following address:

Ollo Card Services

P.O. Box 660371

Dallas, TX 75266-0371

Select the method that suits you best and ensures a seamless payment experience for your Ollo Platinum Mastercard.

How to Reach Ollo Customer Service: Phone Numbers and Support

Ollo Customer Service Phone Number: (877) 494-0020

- Dial (877) 494-0020 for all customer inquiries and support related to your Ollo credit card login . Whether you have questions about payments, card activation, or need assistance with lost or stolen cards, this is the primary line of communication.

For International Customers: +1 (516) 224-5600

- If you are located outside the United States, reach Ollo’s international customer service line at +1 (516) 224-5600. The format of the number remains the same for international customers, offering assistance for various credit card-related matters.

Feel free to use these dedicated phone numbers to connect with Ollo Credit card login Customer Service and address any queries or concerns you may have regarding your credit card.

Final Words

The Ollo Credit Card Login stands as a robust and user-friendly digital platform, offering cardholders seamless access to their credit card accounts. This online portal extends a range of advantages, encompassing 24/7 account accessibility, real-time balance tracking, efficient payment management, and advanced security features.

Beyond simplifying financial oversight, the Ollo Credit Card Login equips cardholders with essential tools for making well-informed decisions about their credit card usage. Whether it’s monitoring spending patterns, staying informed about credit limits, or unlocking access to rewards and exclusive offers, this platform prioritizes control and transparency, elevating the overall credit card experience.