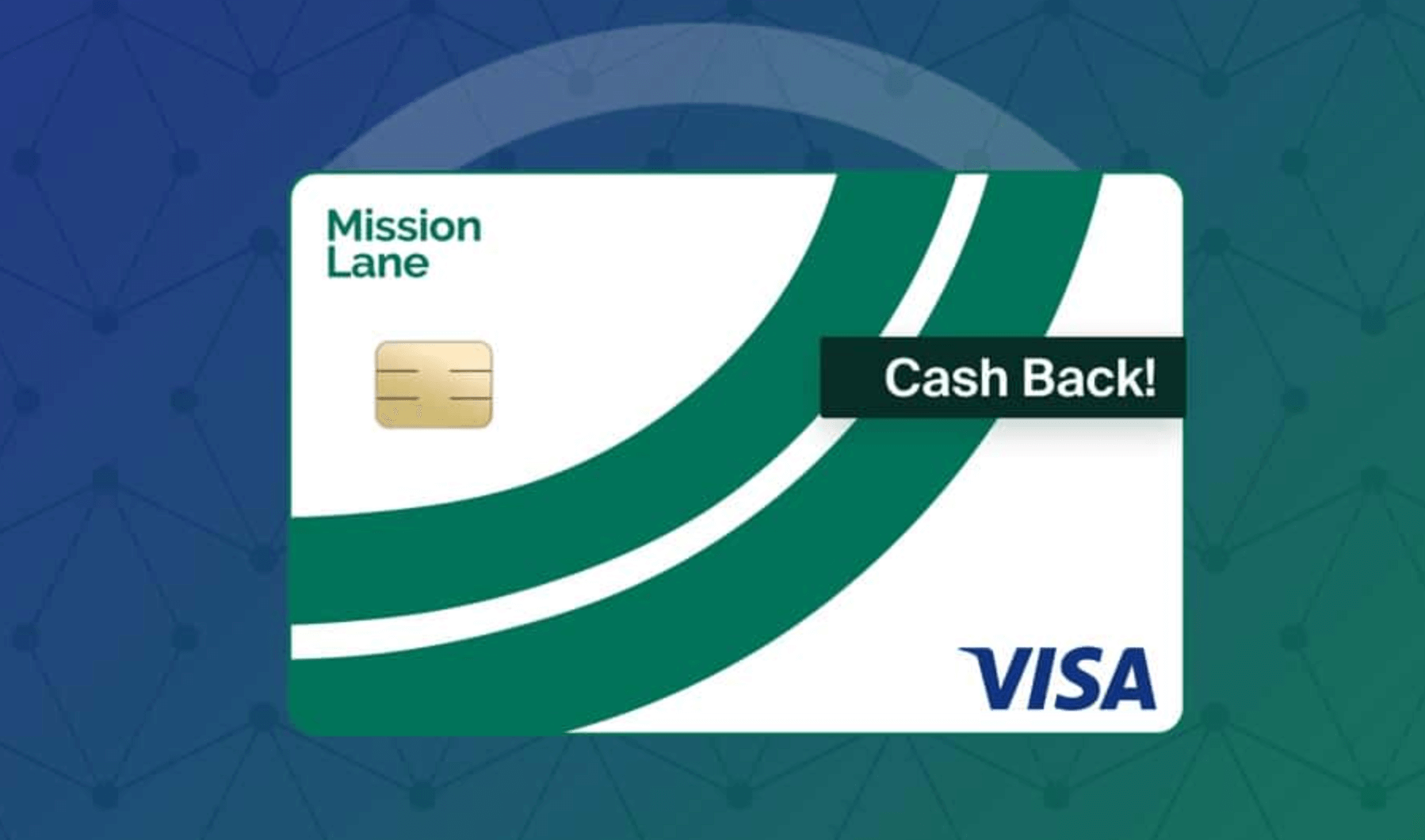

Mission Lane Credit Card stands out from many credit cards designed to assist consumers with fair or poor credit by not requiring a security deposit. Instead, applicants must prequalify or fill out a full application to determine their annual fee and credit limit before making a final decision.

Though your initial credit limit may seem small, responsible card usage could increase. Furthermore, this card reports to all three major credit bureaus.

Mission Lane Login Portal

Mission Lane Credit Card offers excellent credit-building benefits for those with bad or no credit, reporting to all three credit bureaus and providing an increase in credit limits with responsible use. Furthermore, this card does not require a cash deposit as is common with secured cards but does come with an annual fee of $59.

This card also boasts some distinctive features, such as free credit score access for cardholders. Furthermore, there is an app available that enables cardholders to manage their accounts and make payments as well as an autopay option and online portal that allows cardholders to manage their accounts easily.

Mission Lane is a financial technology company offering unsecured credit cards to those who don’t meet traditional lender qualifications. Established in 2018, Mission Lane operates out of Atlanta, Georgia, and acts as a servicing agent for banks that issue cards while working to improve customers’ credit histories. CB Insights’ Expert Collection features Mission Lane as one of the companies worth watching – this collection provides users with relevant and timely insights about key players within various fields of technology.

READ MORE:-IndiGo HDFC Credit Card: Review & Benefits

Mission Lane Credit Card Login

Mission Lane Credit Card Login is simple and user-friendly, offering the ability to track transactions easily while managing your account effortlessly. Furthermore, they offer exceptional customer support. To use their card they require registration either on their website or app available for iOS and Android devices.

The prequalification feature of this card can be extremely helpful, enabling you to assess if you will be approved without incurring an inquiry on your credit report. Furthermore, after seven months of responsible usage and potential credit limit increase opportunities could become available – but be wary as this card carries a high APR with no rewards program available for use.

If you need a credit card, the Mission Lane Credit Card could be the right fit. Designed specifically to assist people with limited or no credit histories in building up their scores by reporting to all three credit bureaus simultaneously, but please be aware that an annual fee ranges from $0 to $59 and will be assessed annually.

Mission Lane Account Access

The Mission Lane Credit Card is an unsecured credit-building card that does not require a security deposit and reports to all three major consumer credit bureaus. Responsible use can help improve your score and may qualify you for an increase after 12 months of on-time payments; however, its high APR could make using it risky for inexperienced users; additional Mission Lane cards cannot be graduated to until your scores have improved sufficiently.

Mission Lane Credit Card’s low credit requirements make it less attractive than other cards for people with poor credit, making its APR less affordable – although this card remains suitable for people who possess fair or excellent credit and wish to build it without paying high interest rates.

Transportation Alliance Bank, Inc. d/b/a TAB Bank of Ogden, Utah issues this card under the authority of Visa U.S.A. Inc. and subject to eligibility criteria and Cardholder Agreement.

Mission Lane Online Login

Mission Lane credit cards offer a practical and cost-efficient way of building credit, without the need for security deposits or deposit fees. They report your monthly payment history directly to all three major credit bureaus for easier making your report while having low annual fees that don’t cost as much (they typically range between $25 and $59 annually and often come with lower credit limits).

If you have fair or poor credit, the Mission Lane Credit Card could be an ideal way to help build it. Although there is no rewards program or welcome bonus offered with it, paying bills on time and in full every month will help boost your score while building credit in general. In order to avoid incurring interest charges it is recommended that utilization rates stay below 30% for optimal use of this credit card.

If you’re interested in applying for the Mission Lane Credit Card, you can do so online through their website or mobile app. Prequalifying requires only a soft inquiry that won’t affect your credit score; however, an official application requires both soft and hard inquiries, which could temporarily reduce it.

Mission Lane Cardholder Login

Mission Lane markets their prepaid debit card as “a better kind of debit card,” and it is easy to see why. All foreign transactions, bill payments, and in-network ATM withdrawals are fee-free as are monthly service fees or hidden costs.

Mission Lane Visa Credit Card offers cash back with no annual fee and low-interest rate, designed specifically to serve those with limited or fair credit who may not otherwise qualify for traditional credit cards without making a security deposit deposit. Furthermore, cardholders gain access to Mission Lane Junction – an information resource center providing articles on various financial topics as well as stories from fellow cardholders who have faced their own obstacles head-on and overcome them successfully.

Responsible use of this card can help to build credit. As it reports to major credit bureaus, paying on time and keeping credit utilization low can boost your score – something that FICO scoring models take into consideration heavily. With its handy app and linked accounts for savings and investments as well as loans you’ve received from Mission Lane you can monitor everything easily!

Some useful links

Mission Lane Account Management

Mission Lane offers an online account management portal, enabling cardholders to view statements, make payments, send inquiries, and request support with their accounts. They also have a customer service phone number cardholders can call to get assistance for their accounts.

This card reports your credit activity to all major credit bureaus, which can help build or rebuild your score. Furthermore, its absence of an annual fee means it could save money compared to cards for bad credit that charge such fees; however, rewards don’t exist with this particular card.

Mission Lane currently provides more than 2 million consumers with its market-leading credit card, in addition to offering other financial products such as the Mission Money debit card and Earn income management tool. Partnering with Plaid increases Mission Lane’s ability to bring modern financial tools such as debit cards to underbanked households as reported in the PYMNTS story, while simultaneously securely connecting its cards with more than 7,000 apps and services via Plaid’s open finance API data connectivity solution, according to a press release from both companies.

READ MORE:-Unlocking Savings: The Ultimate Guide to Carter’s Credit Card Benefits

Mission Lane Login Process

Mission Lane credit card provides an accessible entryway for those with bad credit looking to rebuild or repair their score. Although it doesn’t offer as many perks as some of its peers in this category, the Mission Lane card still reports to all three major credit bureaus and can help boost your score over time with responsible use.

If you want a Mission Lane credit card, applying online and filling out a short form to see if you qualify can be done in minutes! Our prequalification process uses soft inquiry to avoid impacting your credit rating and can provide instant results if pre-qualified; after which, if pre-approved you can view annual fee and APR estimates before submitting a full application.

Log into your Mission Lane account via the website or mobile app, to pay your credit card bill, track account activity, and access other features. Your card’s terms and conditions as well as its Cardholder Agreement can also be found online – this agreement serves as the governing document for how it’s used by card users.

Mission Lane credit card login

If you’re in search of a card to help build your credit, the Mission Lane Visa credit card might be ideal. Offering cash back on everyday purchases and reporting to all three major bureaus (which could help boost your score), this unsecured card may offer just what’s necessary – though with limited benefits it may not suit long-term use.

Payments on your Mission Lane card can be made by accessing either its website or mobile application for iOS and Android or calling the customer service number located on its back.

This card doesn’t require a security deposit and allows you to check eligibility for an increase in credit limits after seven months of on-time payments, using its soft prequalification process which avoids hard pulls on credit, potentially temporarily lowering scores in the process. Unfortunately, its limits and rewards are relatively modest.

Q1: What is the Mission Lane Visa Card?

The Mission Lane Visa Card is an unsecured credit card designed to assist individuals with fair or poor credit in building or rebuilding their credit history.

Q2: Does the Mission Lane Visa Card require a security deposit?

No, this credit card does not require a security deposit, unlike many other credit-building cards.

Q3: How does the prequalification process work?

Applicants can prequalify for the card without affecting their credit score. This process helps assess their approval chances.

Q4: Does the card report to credit bureaus?

Yes, the Mission Lane Visa Card reports to all three major credit bureaus, which can positively impact your credit history when used responsibly.

Q5: What are the annual fees for the card?

The card comes with an annual fee of $59, although it may range from $0 to $59, depending on your application and creditworthiness.

Q6: Are there any rewards or cashback programs?

Unfortunately, the Mission Lane Visa Card does not offer a rewards program or cashback benefits.

Q7: How can I apply for the Mission Lane Visa Card?

You can apply online through their website or mobile app, and the prequalification process uses a soft inquiry to check your eligibility.

Q8: How can I manage my Mission Lane Credit Card account?

You can manage your account through the mobile app, the online portal, or by calling their customer service number.

Q9: Can my credit limit increase over time?

Yes, with responsible card usage, your credit limit may increase, especially after 7 months of on-time payments.

Q10: Is there a grace period for interest charges?

The card has a high APR, so to avoid interest charges, it’s recommended to pay your balance in full each month.