In today’s fast-paced world, digital banking has become an integral part of our lives. People prefer to manage their finances online as it saves time, is more convenient, and offers a wide range of features. UCO Bank, one of the leading public sector banks in India, has introduced its mPassbook app which aims to provide customers with an easy and secure way to manage their accounts digitally. This article explores the features, benefits, and how to use UCO Bank’s mPassbook app.

What is UCO Bank mPassbook?

UCO Bank’s mPassbook is a digital banking solution that allows customers to view their account details, transactions, and balances anytime, anywhere. It is an electronic version of the traditional passbook that customers use to keep track of their transactions. The app is available for both Android and iOS platforms and can be downloaded from the respective app stores.

READ MORE:-UCO Bank’s Net Banking: Easy Registration, Secure Login, and a Wealth of Convenient Services

Features of UCO Bank mPassbook

UCO Bank’s mPassbook app offers a range of features that make banking more convenient for customers. Some of the key features are:

- Real-time updates: The app provides real-time updates of transactions and account balances, eliminating the need for customers to visit the bank or use an ATM to get the latest information.

- Transaction history: Customers can view their transaction history for the past six months, making it easier to track their expenses and manage their finances.

- Secure login: The app offers a secure login process that requires a customer ID and password, ensuring that only authorized users can access the account information.

- Multiple accounts: Customers can link multiple accounts to the app, allowing them to manage all their accounts in one place.

- Offline access: The app allows customers to view their account details even when they are not connected to the internet. The information is stored locally on the device and can be accessed offline.

- Customization: The app offers customization options, allowing customers to personalize their account details and view their preferred transaction history.

- Notifications: The app sends notifications for transactions and balance updates, ensuring that customers are always aware of their account activity.

READ MORE:-AirtelTez Login Portal | Airtel Payment Bank Retailer Login 2023

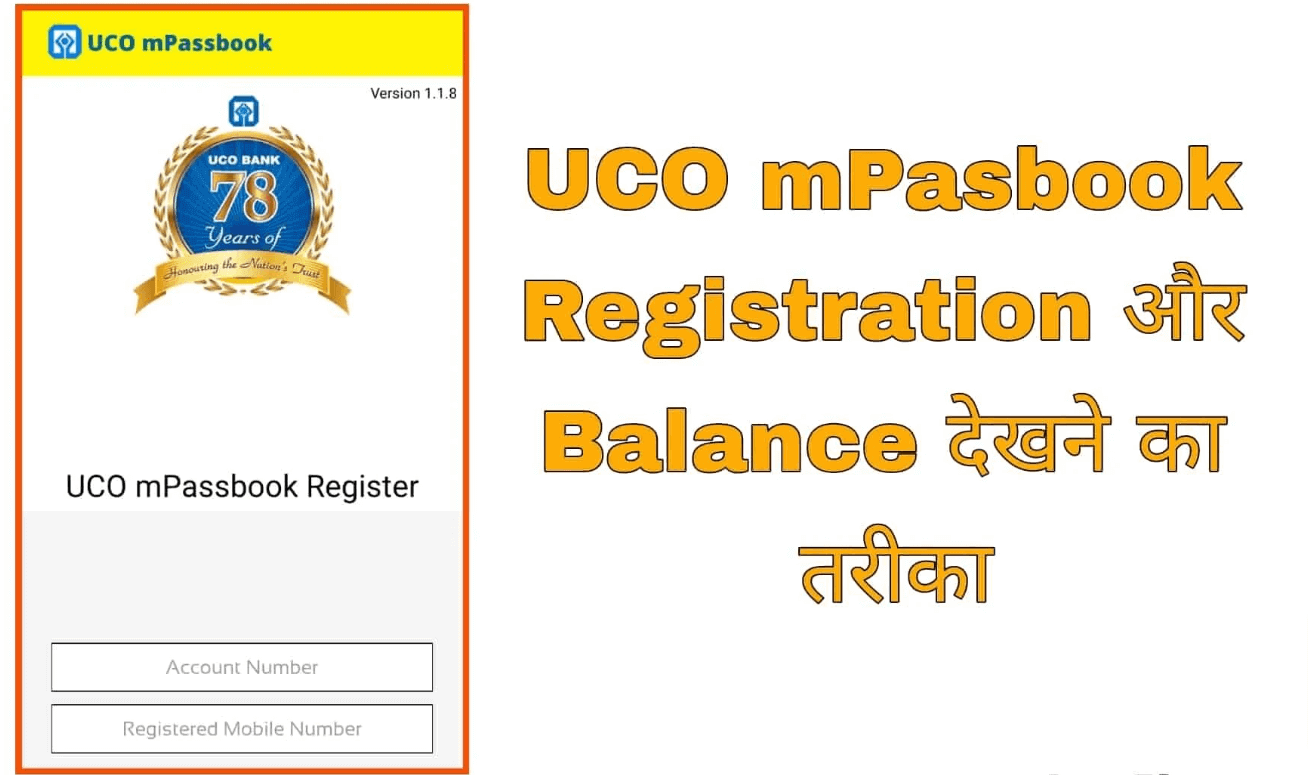

How to use UCO Bank mPassbook?

Using UCO Bank’s mPassbook app is easy and straightforward. Here’s how you can get started:

Step 1: Download the app from the Google Play Store or Apple App Store.

Step 2: Once the app is downloaded, open it and enter your customer ID and password.

Step 3: After logging in, you will be prompted to enter a 6-digit MPIN. This MPIN will be used to access the app in the future, so make sure to remember it.

Step 4: Once you have set up the MPIN, you can start using the app to view your account details, transactions, and balance.

Step 5: You can customize the app settings to view your preferred transaction history and account details.

Benefits of UCO Bank mPassbook

UCO Bank’s mPassbook app offers a range of benefits to customers. Some of the key benefits are:

- Convenience: The app allows customers to access their account details anytime, anywhere, making banking more convenient and hassle-free.

- Time-saving: Customers no longer have to visit the bank or use an ATM to get the latest information on their accounts. The app provides real-time updates, saving time and effort.

- Secure: The app offers a secure login process and uses encryption to protect customer data, ensuring that their account information is safe and secure.

- Easy to use: The app is easy to use, and customers can quickly view their account details and transaction history.

- Cost-effective: The app is a cost-effective solution as customers no longer have to

- pay for physical passbook printing or ATM usage to access account details.

- Environmentally friendly: The app is an environmentally friendly solution as it eliminates the need for physical passbook printing, reducing paper usage and waste.

- Multiple accounts management: Customers can link multiple accounts to the app and manage them all in one place, making it easier to keep track of their finances.

- Instant notifications: The app sends instant notifications for transactions and balance updates, ensuring that customers are always aware of their account activity.

- Offline access: The app allows customers to view their account details even when they are not connected to the internet, making it a reliable solution in areas with poor network connectivity.

READ MORE:-Canara Bank CSP Apply Online | CSC Canara Bank CSP Registration

UCO Bank mpassbook login

To log in to UCO Bank mPassbook, follow these steps:

- Download the UCO Bank mPassbook app from the Google Play Store or Apple App Store.

- Once the app is downloaded, open it and click on the “Login” button.

- Enter your Customer ID and Registered Mobile Number associated with the account.

- Next, enter the OTP (One-Time Password) received on your registered mobile number.

- Set a 4-digit MPIN (Mobile Personal Identification Number) to access your account.

- Once you have set the MPIN, you can use it to log in to the app.

- Enter the MPIN and click on the “Login” button.

- You will now be able to view your account details, transaction history, and balance.

UCO Bank mpassbook App

UCO Bank mPassbook is a digital banking app designed for UCO Bank customers to view their account details, transactions, and balance on their mobile devices. The app is available for download on the Google Play Store and Apple App Store, making it accessible to a wide range of users.

The app offers a range of features and benefits, including:

- Secure login process: The app offers a secure login process, ensuring that customer data is protected.

- Easy-to-use interface: The app has an intuitive and user-friendly interface, making it easy for customers to navigate and use.

- Real-time account information: Customers can view their account details, transaction history, and balance in real-time, eliminating the need for physical passbook printing.

- Customizable settings: The app offers customization options, allowing customers to personalize their account details and view their preferred transaction history.

- Cost-effective solution: The app eliminates the need for physical passbook printing, saving customers money on printing costs.

- Environmentally friendly: The app is an environmentally friendly solution as it eliminates the need for physical passbook printing, reducing paper usage and waste.

- Multiple accounts management: Customers can link multiple accounts to the app and manage them all in one place, making it easier to keep track of their finances.

- Instant notifications: The app sends instant notifications for transactions and balance updates, ensuring that customers are always aware of their account activity.

- Offline access: The app allows customers to view their account details even when they are not connected to the internet, making it a reliable solution in areas with poor network connectivity.

IMPORTANT LINK

UCO mPassbook Apk Download for Android

UCO mPassbook – APK Download for Android

Get UCO mPassBook – Microsoft Store en-GB

UCO mPassbook on the App Store

UCO mPassbook – Apps on Google Play

Conclusion

UCO Bank’s mPassbook app is a convenient and secure solution for customers looking to manage their accounts digitally. With its range of features and benefits, the app offers a hassle-free banking experience, allowing customers to view their account details, transactions, and balance anytime, anywhere. The app is easy to use and can be customized to suit the customer’s preferences. With the growing popularity of digital banking, UCO Bank’s mPassbook app is a step towards a more efficient and sustainable banking system.

Related Faq

- What is UCO Bank mPassbook?

UCO Bank mPassbook is a digital banking solution that allows customers to view their account details, transactions, and balance anytime, anywhere. It is an electronic version of the traditional passbook that customers use to keep track of their transactions.

- How can I download UCO Bank mPassbook?

UCO Bank mPassbook can be downloaded from the Google Play Store or Apple App Store. Simply search for “UCO Bank mPassbook” in the app store and download the app.

- Is UCO Bank mPassbook secure?

Yes, UCO Bank mPassbook offers a secure login process and uses encryption to protect customer data, ensuring that their account information is safe and secure.

- Can I link multiple accounts to UCO Bank mPassbook?

Yes, customers can link multiple accounts to the app, allowing them to manage all their accounts in one place.

- Does UCO Bank mPassbook work offline?

Yes, UCO Bank mPassbook allows customers to view their account details even when they are not connected to the internet. The information is stored locally on the device and can be accessed offline.

- Can I customize the settings in UCO Bank mPassbook?

Yes, UCO Bank mPassbook offers customization options, allowing customers to personalize their account details and view their preferred transaction history.

- What are the benefits of using UCO Bank mPassbook?

UCO Bank mPassbook offers a range of benefits, including convenience, time-saving, security, cost-effectiveness, multiple accounts management, instant notifications, and offline access.

- Can I use UCO Bank mPassbook for all banking transactions?

No, UCO Bank mPassbook is designed for viewing account details and transaction history only. For other banking transactions, customers need to use other banking services provided by UCO Bank.