15 Largest Banks in the US have total assets of $15 trillion as per the report of Dec 31, 2022. There are some changes in the list of biggest banks in America. Some larger banks are getting replaced by each other and smaller banks are getting off the list by the best-growing financial companies.

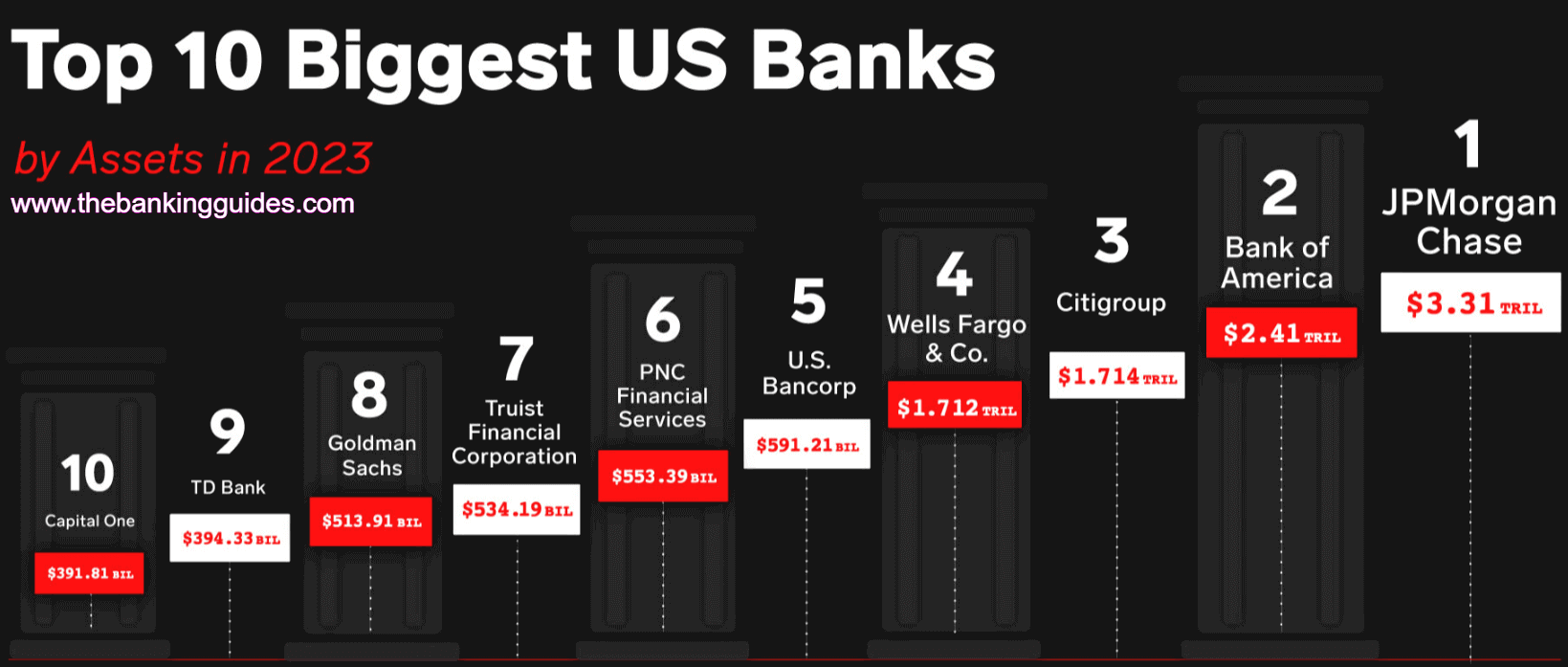

The Federal Reserve has declared a list of the biggest American banks based on the assets by the year 2023. So, here we are going to share how some banks are able to get a top position.

However, the top four banks JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo are spending most of their profit on mobile banking apps to meet the requirements of the customers.

Biggest banks are now focusing on Internet technology to give a better experience of banking services to the customers. Nowadays, digital payments are increasing in demand but it is very important in today’s internet and mobile world.

Below we have listed the 15 largest banks in the US on the basis of assets as per the report of the Federal Reserve.

15 Biggest American Bank

| Position | American Bank Name | Assets |

| 1 | JPMorgan Chase | $3.67 trillion |

| 2 | Bank of America | $3.05 trillion |

| 3 | Citibank | $1.80 trillion |

| 4 | Wells Fargo Bank | $1.875 trillion |

| 5 | U.S. Bancorp | $674.805 billion |

| 6 | PNC Bank | $557 billion |

| 7 | Truist Bank | $555.255 billion |

| 8 | Capital One Financial | $444.23 billion |

| 9 | Goldman Sachs | $1.44 trillion |

| 10 | TD Bank Ltd. | $1.92 trillion |

| 11 | Charles Schwab Financial Corporation | $551.8 billion |

| 12 | Bank of New York | $405.8 billion |

| 13 | State Street Bank | $301.45 billion |

| 14 | Citizen Bank Ltd. | $225. 56 billion |

| 15 | First Republic Bank | $210.05 billion |

Now let’s know how these banks managed their position in the list of biggest banks in the US.

Largest Banks in the U.S.

1. JPMorgan Chase Bank

Chase Bank is one of the largest banks in the United States and is part of JPMorgan Chase and Co. It provides digital banking services by introducing artificial intelligence which stands out from the other banks in the US.

This American Bank is continuously working and investing in banking technology with a budget of $11.5 billion. The bank uses these funds to implement AI to optimize banking services to the next level by using voice assistant features. With this implementation, customers can also check stock exchange data and analysis reports.

Chase Bank merged with Wells Fargo, making it the biggest bank in the US with the largest network. Currently, it has 4700 bank branches in the United States and 33 across the world and almost 16,000 ATMs situated. If you are looking for a big bank in the US, then Chase is the no.1 option for you. They provide lots of benefits to new customers such as sign-up bonuses and promotional offers.

Let’s check some facts about Chase Bank:

- Headquarters: New York

- Total Assets: US$3.67 trillion

- Total Deposits: US$2.76 trillion

- Net income: US$37.68 billion

- Revenue: US$128.7 billion

- No. of employees: 293, 723

- No. of Branches: 4,700

- No. of ATMs: 16,000

2. Bank of America

Bank of America is the second biggest American Bank with consolidated assets of $2.50 trillion. This is a multinational bank that has subsidiaries such as Merrill, Bank of America Securities, and Bank of America Private Bank. It provides digital banking to customers through a mobile banking app.

In the year 2022, Bank of America reduced its overdraft and NSF fee by following the industry trend same as the other biggest banks. The bank offers services to almost 68 million customers and small businesses. It has fewer branches than the top three banks, but the bank has lots of ATMs by merging with Chase.

This bank was launched in 2017. It is continuously working on cutting the possible cost to attract young users and help them to adapt to digital banking. The American Bank allows their customers to do transactions through online banking and Contactless ATMs. Bank of America has a huge customer base of 15 million and they can send money to other people easily through Zelle.

Let’s check some facts about Bank of America:

- Headquarters: Charlotte, North Carolina

- Total Assets: US$3.05 trillion

- Total Deposits: US$2.30 trillion

- Net income: US$27.53 billion

- Revenue: US$94.95 billion

- No. of employees: 217,000

- No. of Branches: 4,400

- No. of ATMs: 17,000

3. Citibank

Citibank is the third largest American bank with total assets of $1.80 trillion. This bank is owned by Citicorp which is a financial services company. The bank has very few branches in the US but it has a large network of ATMs.

According to Kiplinger’s Personal Finance, Citibank has been the ‘Best Bank for High net-worth families’ for 4 consecutive years. It allows customers to access Citigold packages by maintaining $200,000 in their deposit and investment accounts. As per the report of Insider Intelligence’s Mobile Banking, Citibank got top rank for its digital banking services and rating by the customers.

The digital platform of this bank allows customers to check recurring charges and financial wellness scores which makes it one of the biggest banks in America. Citibank is currently working to launch Crypto services because of high interest from customers. Currently, this bank has a network of 1000 branches in the USA and 65,000 ATMs.

Let’s check some facts about Citibank:

- Headquarters: New York

- Total Assets: US$1.80 trillion

- Total Deposits: US$1.40 trillion

- No. of branches: 1000

- No. of ATMs: 65,000

4. Wells Fargo Bank

Wells Fargo is the 4th largest American bank which was established in the year 1852. The bank introduced the mobile banking app to allow customers to get access to banking services without visiting the bank. It has total assets of $1.79 trillion as of 2023.

In addition, Wells Fargo’s app, a greenhouse allows customers to analyze their bills and track monthly spending. Last year, the bank was continuously working to generate more revenue through services like Credit Cards.

Due to the increasing demand for contactless payment, this bank is getting lots of customers. So, because of this, it managed to get the 4th position in the list of largest banks in the US. Nowadays, almost 80% of US merchants are accepting online payment and 48% of US consumers are using online payment methods to do transactions.

In recent years, the bank has been highlighted in lots of controversies. But, it is constantly working on improving its image. Now, Wells Fargo offers a wide range of products and services such as savings accounts, credit cards, loans, etc.

Facts about Wells Fargo:

- Headquarters: San Francisco, California

- Total Assets: US$1.875 trillion

- Total deposits: US$1.50 trillion

- Revenue: US$73.8 billion

- Net income: US$13.2 billion

- No. of employees: 238, 698

- No. of branches: 4,800

- No. of ATMs: 12,500

5. U.S. Bancorp

U.S. Bancorp is the bank holding company that owns the U.S. Bank National Association. This bank got the 5th rank in the largest banks in the US list by assets of $590.15 billion. It was started in 1863 and now merged with lots of banks which created a large branch network.

Year after year, U.S Bancorp is working on optimizing technology to merge with some tech companies like Facebook, Amazon, Apple, and Google as they are thinking of launching banking services. According to a resource, the financial officer of U.S. Bancorp said “It is planning to tie up with some fintech companies to secure the spot in the list of biggest banks in the US.

This is Minneapolis-based U.S. Bank which launched the voice assistant banking app in the Spanish language. As it is one of the biggest banks in the US, U.S. Bancorp has a wide network of 2,800 branches and 5,100 ATMs in more than half of the US area.

These are some facts about U.S. Bancorp:

- Headquarters: Minneapolis, Minnesota

- Total Assets: US$674.805 billion

- Total Deposits: US$480.12 billion

- Revenue: US$24.302 billion

- Net income: US$5.825 billion

- No. of employees: 77,000

- No. of branches: 2,800

- No. of ATMs: 5,100

6. PNC Bank

PNC Bank got 6th position in the list of largest banks in the US. This bank was established in 1852. With total assets of $550.45 billion, it managed to become the top bank in America. In 2020, the bank paid $11.6 billion to acquire BBVA USA.

It is the top American bank because of its amazing products and services for customers. Customers with Visa commercial cards can use mobile payment options and access mobile wallets like Apple Pay.

PNC Bank is continuously working on removing spam and fighting fraud to protect the bank accounts of their customers. Nowadays, fraudsters can easily guess the CVV codes of a customer’s Debit and Credit card, so to get away from fraud, the bank regularly changes the CVV of cards to protect accounts.

Currently, this Pittsburgh-based bank operates in the Northeast, Midwest, and South. PNC Bank is the result of the merging of two banks that can be referred to as Pittsburgh National Corporation and Provident National Corporation.

Facts about PNC Bank:

- Headquarters: Pittsburgh, Pennsylvania

- Total Assets: US$557 billion

- Total Deposits: US$440.56 billion

- Revenue: US$21.1 billion

- Net income: US$6.1 billion

- No. of employees: 59,426

- No. of branches: 2,400

- No. of ATMs: 18,500

7. Trust Bank

Trust Bank is also one of the largest banks in the US. It was formed by the merging of two banks named SunTrust and BB&T. These two banks SunTrust and BB&T were in the 11th and 12th position in the biggest banks in the US list in the year 2019. But after merging, Trust Bank is now on the list of top 10 American banks.

Now, the combined bank provides a wide range of products and services such as commercial banking, securities brokerage, asset management, insurance, mortgage, and financial services. Truist Bank has launched Truist One Banking accounts by which customers can easily enjoy banking services without overdraft fees.

This is a completely new bank in which you cannot open a bank account easily. If you have a previous BB&T or Suntrust account, then your account will be automatically converted into a Truist bank account after the process is completed. The American Bank has consolidated assets of $540.16 billion.

Facts about Trust Bank:

- Headquarters: Charlotte, North Carolina

- Total Assets: US$555.255 billion

- Total Deposits: US$430.45 billion

- Revenue: US$20.370 billion

- Net income: US$4.492 billion

- No. of employees: 51,169

- No. of branches: 2200

- No. of ATMs: 3,000

8. Capital One Financial

Capital One is the parent company of Capital One Bank. According to the Federal Reserve, the bank secured the 8th position in the list of largest banks in the US by assets of $450.67 billion as of 2022. This bank is headquartered in McClean Virginia and now operates branches in Texas, East Coast, Louisiana, New York, and Maryland.

It is rapidly increasing its technology staff to launch an AI-powered chatbot named Eno which works similarly to Erica. This American bank got the first position in the Banking Digital Trust Report because of its strength. It has recently migrated its services to cloud servers which enhanced the security protocols, facilitated upgrades, etc.

In the year 2019, Capital One acquired United Income which provides wealth management services for people reaching the retirement stage. The result gives access to companies to provide technological features with human interactions. It is in high demand by customers who still like to get human interaction for wealth management services. This bank also provides some financial coaching in their Capital One Cafes.

Facts about Capital One Bank:

- Headquarters: McLean, Virginia

- Total Assets: US$444.23 billion

- Total Deposits: US$330.45 billion

- Revenue: US$38.37 billion

- Net income: US$1.16 billion

- No. of employees: 50,800

- No. of branches: 790

- No. of ATMs: 77,000

9. Goldman Sachs

Goldman Sachs got 9th position in the list of largest banks in the US by the Federal Reserve. It is an investment banking, management, and securities company. The bank allows customers to access banking products and services. This bank is a New York-based Investment bank that is on the list of biggest banks in the US for the first time in 2022 with consolidated assets of $430.34 billion.

The online banking firm of this bank named Marcus came into existence in year 2016 and started providing personal loans and financial products and services such as savings accounts, credit cards, deposits, etc. In the year 2022, the wealth management revenue of Goldman increased to 18% because of its credit card services and higher interest rates. In addition, the fixed income of this American bank also increased by 41%.

Now, it has launched lots of products and services to fulfil its losses in other areas. The savings account and CDs of this American bank can be accessed online which provides higher interest rates.

Facts about Goldman Sachs:

- Headquarters: New York

- Total Assets: US$1.44 trillion

- Total Deposits: US$2.55 trillion

- Revenue: US$47.37 billion

- Net income: US$11.26 billion

- No. of employees: 48,500

- No. of branches: 0

- No. of ATMs: 0

10. TD Bank Ltd.

TD Bank has gained the 10th position in the list of biggest banks in the US. It is headquartered in Cherry Hill, New Jersey. The bank has total assets of $390.12 billion. This bank is the commercial banking company of TD Bank Group of Canada.

The American Bank provides different kinds of products and services for commercial and small business clients such as deposit accounts, credit cards, mortgages, etc. TD Bank has become the top US banks because of its implementation of artificial intelligence and digital intelligence in banking services.

It has launched an AI-powered chatbot named Clari which solves customer’s queries via text message and informs them about a new payment or credit card payment. This bank is planning to introduce a similar chatbot for its US branches. TD Bank partnered with fintech, Amount which helps in fraud detection and account verification.

Currently, TD Bank has 1200 branches and 700 ATMs in the United States. Most of its bank branches are open for a full week.

Facts about TD Bank:

- Headquarters: Cherry Hill, New Jersey

- Total Assets: US$1.92 trillion

- Total Deposits: US$350.23 billion

- Revenue: CA$49.03 billion

- Net income: $17.43 billion

- No. of employees: 94,867

- No. of branches: 1,200

- No. of ATMs: 700

11. Charles Schwab Financial Corporation

Charles Schwab Bank got 11th position in the list of biggest banks in the US by the Federal Reserve as of 2022. This American bank has assets of $380.15 billion. It provides a wide range of financial products and services such as brokerage accounts, investment accounts, checking accounts, and retirement accounts.

Charles Schwab is headquartered in San Francisco, California, and now operates 360 branches.

Facts about Charles Schwab:

- Headquarters: San Francisco, California

- Total Assets: US$551.8 billion

- Total Deposits: US$350.52 billion

- Revenue: US$20.76 billion

- Net income: US$6.64 billion

- No. of employees: 35,300

- No. of branches: 400

- No. of ATMs: 0

12. Bank of New York Mellon

Bank of New York Mellon is an investment company that has assets of $350.12 billion as of Federal Reserve 2022. This was the first American bank that traded after the opening of the New York Stock Exchange in 1792.

Bank of New York Mellon is a merger bank of Mellon Financial Corporation and The Bank of New York. It can also be abbreviated as BNY Mellon. This bank mostly provides investment products and services to customers such as banks, insurance companies, asset managers, corporations, etc. It also provides private banking services to the VIP customers.

Facts about the Bank of New York Mellon

- Headquarters: New York City, New York

- Total Assets: US$405.8 billion

- Total Deposits: US$300.12 billion

- Revenue: US$16.38 billion

- Net income: US$2.362 billion

- No. of employees: 51,700

- No. of branches: 51

- No. of Employees: 52,000

The Banking Guides Official Social Media

| Click here | |

| Click here | |

| Click here | |

| Click here | |

| Quora | Click here |

| Official website | Click here |

Conclusion

Now you know about the largest banks in the US. All these banks have combined consolidated assets of $15 trillion. The top four American banks JPMorgan Chase, Bank of America, Citibank, and Wells Fargo managed to get their position because of their digital payment options.

They allow their customers to access banking services through a mobile banking app. It also provides them with contactless transactions. The top four biggest banks in the US have assets of more than $1 trillion, while the remaining largest banks in the US list have billions of dollars.

If you are looking for the best American Bank to open savings or Investment accounts then you can go with any bank from the list of largest banks in the US. All the banks in the list give digital payment access to their customers. They also constantly optimize their products and services to get protected from spammers and fraudsters.

I hope you enjoyed this post and got valuable information about the largest banks in the US. If you have other queries, then you can ask us in the comment section.

People Also Ask

Which are the 10 biggest banks in the US?

Above in this guide, we have created a complete list of more than 15 largest banks in the US.

Which are the big four American Banks?

According to the Federal Reserve, JPMorgan Chase, Bank of America, Wells Fargo, and Citibank are the big four banks in the US which are also the top banks worldwide by assets.

Which is the most trusted bank in America?

According to Lifestory research of America’s Most Trusted Bank 2022, Chase is the most trusted bank in the US.

Among all American banks, which have branches in almost 50 states?

Chase is the first national bank that has a presence in 48 states of the United States.

What is the number 1 bank in India?

JPMorgan Chase is the first bank in America that has 4,700 branches and almost 16,000 ATMs.

Which bank is mostly used by millionaires in the USA?

The Millionaires in the USA have opened their accounts in Bank of America, Citibank, HSBC, and Union Bank.

Which is the most powerful bank in the world?

Industrial and Commercial Bank of China Ltd. is the largest bank in the world in terms of assets and gross revenue.

Note: Friends, we bring here the information about the scheme of the Central and State governments for you. So, you can save this website thebankingguides.com in your bookmarks. By clicking the link above, you can connect to all our social media platforms.

If you like this article then share it with your friends and family.

Thanks for reading this article till the end.

4 thoughts on “Top 15 Largest Banks in the US by Assets in 2023”

Comments are closed.