HDFC Credit Card Apply. HDFC Bank is a well-known and respected banking company in India that regularly introduces new schemes for its customers. This benefits customers of HDFC Bank greatly and makes it easy for them to access banking services.

Recently, HDFC Bank launched a new scheme in which customers can apply for a credit card based on their credit score. In this article, we will tell you how you can apply for an HDFC Bank credit card online and also provide information on the bank’s services.

HDFC Bank is India’s largest private banking company. If you have an account with this bank, you will know that the bank provides excellent services to its customers.

HDFC Bank is known to be one of the best banks in India that provides excellent services to its customers. While they may charge a bit more for their services, the quality of service provided by the bank is worth it.

HDFC Credit Card Apply Online

HDFC Bank started providing credit cards in India in 2004 and initially issued credit cards in over 100 cities. Since then, the bank has been providing credit cards in almost all parts of the country.

We have mentioned below the process of how you can apply for an HDFC Bank credit card online, which is quite simple. It is very easy to apply for an HDFC Bank credit card online. You can easily apply for an HDFC Bank credit card online.

Read More: HDFC Mini Statement: How to Get Mini Statement of HDFC Bank

The highlight of HDFC Bank Credit Card Online Apply

| Article Name | HDFC Bank Credit Card Online Apply |

| Occupation | Salaried or Self-Employed |

| Beneficiary | Whose Credit Scores Are Good |

| Apply through | Online/Offline |

| Official Website | Click Here |

Best HDFC Credit Cards 2023

| HDFC Credit Card Type | Best for | Annual fee |

| HDFC Bank Diners Club Black Card | Premium Lifestyle | Rs. 10,000 |

| HDFC Freedom Credit Card | Rewards | Rs. 500 |

| HDFC Bank Regalia Card | Premium Lifestyle | Rs. 2,500 |

| HDFC Bank Regalia First Card | Premium Lifestyle | Rs. 1,000 |

| HDFC Bank Moneyback Credit Card | Cashback | Rs. 500 |

| HDFC Bank Platinum Times Card | Regular Lifestyle | Rs. 1,000 |

| HDFC Bank Diners ClubMiles Card | Premium Lifestyle | Rs. 1,000 |

| HDFC Millenia Credit Card | Cashback | Rs. 1,000 |

| Tata Neu Plus HDFC Bank Credit Card | Rewards points | Rs. 499 |

| INFINIA Metal Credit Card | Super Premium Cards | Rs. 12,500 |

| Regalia Gold Credit Card | Reward Points | Rs. 2,500 |

| Tata Neu Plus HDFC Bank Credit Card | Reward Points | Rs. 499 |

| Shoppers Stop HDFC Bank Credit Card | First Citizen Card | Lifetime free |

| Shoppers Stop Black HDFC Bank Credit Card | First Citizen Card | Rs. 4,500 |

| InterMiles HDFC Bank Diners Club | Premium travel | Rs. 5,000 |

| IRCTC HDFC Bank Credit Card | Reward Points | Rs. 500 |

What are the features of HDFC Bank Credit Card?

These are the features of HDFC Credit Cards:

- It provides amazing offers, discounts, and reward points

- You can request a credit card block in case of credit card fraud.

- HDFC Bank provides different kinds of credit cards to cater to every need of the customers

- The credit score can be easily improved by paying the credit card bill on time.

Who can apply for an HDFC Bank credit card?

If you want to apply for an HDFC Bank credit card online, here is a list of the people who are eligible to receive a credit card from HDFC Bank.

HDFC Bank only offers credit cards to individuals who are 21 years old or older and have a regular income source or are self-employed. Other factors that may be considered when applying for a credit card include a good credit score and other financial information. Individuals 25 years old or older who are self-employed may also be eligible for a credit card from HDFC Bank.

Read More: HDFC Balance Check Number | How to Check HDFC Bank Balance

What is the age requirement to apply for an HDFC Bank Credit Card?

To be eligible to apply for a credit card online, the minimum age requirement is:

To be eligible to apply for a credit card online, an individual must be a salary earner and be at least 21 years old. They must also have a regular source of income, a good credit score, and be a self-employed individual between the ages of 40 and 70, or over the age of 25.

Track your Credit Card Application Status -:: HDFC Bank::

Benefits and Features of Top 10 HDFC Credit Cards

HDFC Bank Diners Club Black Card

- 5x reward points for spending every Rs. 150/-

- Free access to more than 700 airport lounges

- 24/7 customer support at both national and international locations

- Free accidental insurance cover, emergency hospitalization, and credit liability

- 6 complimentary access to golf games every 3 months

HDFC Bank Regalia First Card

- 15% discount for dining purchases at famous restaurants in India

- 7,500 reward points on reaching the spending milestone of Rs. 6 lakh

- Foreign currency change fee of 2% for international transactions

- Free Priority Pass Membership to access more than 700+ airport lounges

- 8 complimentary access to domestic lounges per year

- Free accidental insurance cover

HDFC Freedom Credit Card

- 5X reward points on railway ticket bookings, dining purchases, etc.

- 10X reward points on spending through HDFC PayZapp, and SmartBUY.

- 25X reward points on birthday spending

- 1 reward point on spending every Rs. 150

- Gift voucher of around Rs. 1,000 on yearly spending of Rs. 90,000

- Free accidental insurance cover of Rs. 50 lakh

HDFC Bank Titanium Times Card

- 2X reward points on online spending

- Free gift voucher of Rs. 500 on spending Rs. 50,000

- Free accidental insurance cover of Rs. 50 lakh

- Zero charges on lost card

HDFC Bank Moneyback Credit Card

- 2X reward points on online spending

- Free gift voucher of Rs. 500 on spending Rs. 50,000

- Free accidental insurance cover of Rs. 50 lakh

- Zero charges on lost card

HDFC Bank Platinum Times Card

- 25% discount on movie tickets and 20% discount on dining bills

- 3 reward points for regular spending and 10 points for dining spending on weekdays

- Free fuel surcharge waiver

- Free accidental insurance cover of 50 lakh

HDFC Bank Diners ClubMiles Card

- Free lounge access at the leading airport across the world

- Easy to book hotel and movie tickets through the Diners Club website

- 15% discount for dining purchases at famous restaurants in India

- Free concierge service at all travel locations

- Additional air insurance cover of Rs. 1.5 crore

HDFC Diners Club Black Credit Card

- Free special entry to golf clubs across India

- Travel coupons of Rs. 750 for every 1000 points

- Easy to redeem points for hotel bookings, flight tickets, movie tickets, etc.

HDFC Platinum Edge Credit Card

- 2 reward points for spending every Rs. 150 through a card

- Free fuel surcharge waiver

- 50% extra reward points for dining purchases

- The transactions through the card are safe and secured

- Easy credit facility with less interest rate

HDFC Titanium Edge Credit Card

- 2 reward points for spending every Rs. 150 through the card

- Additional 50% reward points on dining purchases

- It helps to redeem reward points for cashback

- Free fuel surcharge waiver

- On instantly reporting the loss of credit card to the bank, there will be zero liability on fraud transactions.

How to check my credit card eligibility?

If you want to apply for an HDFC Bank credit card online, several criteria will be taken into consideration when your application is reviewed. Some of these basic requirements include: being over the age of 21, having a regular source of income, and having a good credit score.

Other factors that may be considered include your employment status (whether you are self-employed or a pensioner), and your age (if you are over 25 and self-employed). HDFC Bank has specific requirements for credit card applicants, which you can learn more about by reviewing their criteria when you apply online.

To apply for an HDFC Bank credit card online, you must be at least 21 years old and no older than 70 years old. You must be a salary-earning individual or self-employed, and you must have a regular source of income and a good credit score. Other requirements may also apply.

Read More: CSC HDFC CSP Apply | HDFC Bank CSP Registration 2023

Which Documents are required to apply for an HDFC Bank Credit Card?

To apply for an HDFC Bank credit card online, you will need to have some documents ready beforehand. We have listed some necessary documents below.

To apply for an HDFC Bank credit card online, you will need the following documents:

- PAN Card

- Copy of Aadhaar Card (with the first 8 digits masked) or any other valid government-issued proof of address

- Other documents, such as your income documents (salary slip, income tax return, etc.), may also be required depending on your credit card eligibility and the bank’s policy. You can apply for an HDFC credit card online through the bank’s net banking platform.

How to apply for an HDFC Bank Credit Card online?

If you want to apply for an HDFC Bank credit card from the comfort of your home, the following information will be helpful. We have provided all the necessary information below so that you can easily apply for an HDFC Bank credit card.

To apply for an HDFC Bank credit card online, you need to follow the steps below:

- Go to HDFC Bank’s official website.

- After that, Click on the “credit card login” option.

- On the website, go to the page for “credit card” and choose a card that is suitable for your needs.

- On the page for the chosen card, click on “Apply Now”.

- Click on “Submit” and you will receive a quick decision based on the information provided in the application.

- If your application is approved, you will receive a call from the SBICard team for verification.

- After the necessary verification, your credit card will be delivered to your preferred address.

Note: If you want to avoid all these steps and apply for an HDFC Bank credit card online directly, you can visit the online credit card application page on their website and apply for an SBI card there.

Read More: How to Check Post Office Savings Account Balance

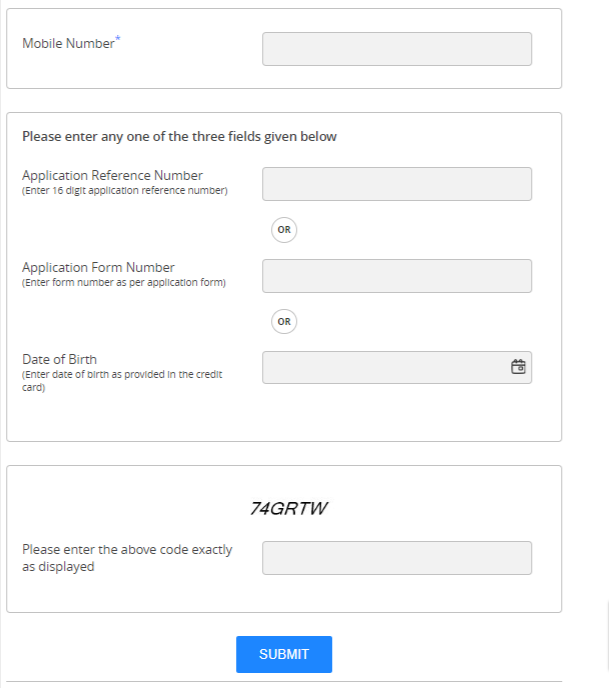

How to Track HDFC Credit Card Application Status?

If you have placed an order for an HDFC credit card and want to know its status, you can follow the steps listed below to track your credit card. HDFC credit card tracking – how to order a credit card.

You can track the status of your HDFC Credit Card application using the application widget on the home page or the online application page. Alternatively, you can use the application widget on the home page or the online application page to track the status of your HDFC Credit Card application.

- Go to the HDFC Bank website.

- On the home page, click on the “Credit Card” page under the “Cards” category.

- On the credit card page, select the credit card that you applied for.

- Scroll down to the bottom of the page and click on the “Track Application” option.

- Enter the application number/reference number that you received when you applied for the card.

- Click on the “Track” button to check the status of your application.

- The status of your application will be displayed on the screen.

What are the reasons for the HDFC Credit Card Application getting rejected?

There are times when an applicant’s application gets rejected and they want to know the reason for it. Below are some of the reasons why an applicant’s application may be rejected:

- Insufficient income: If the applicant’s income is not sufficient to meet the credit card eligibility criteria, their application may be rejected.

- Poor credit score: If the applicant has a poor credit score, their application may be rejected.

- Unstable employment: If the applicant has an unstable employment history, their application may be rejected.

- Existing debt: If the applicant has a lot of existing debt, their application may be rejected.

- Lack of necessary documents: If the applicant has not provided all the necessary documents required for the credit card application, their application may be rejected.

- Misrepresentation of information: If the applicant has provided incorrect or misleading information in their application, their application may be rejected.

Your application for an Hdfc credit card may get rejected due to these reasons:

- Non-availability of required information/documents

- Low Credit Score| HDFC Bank bank credit card apply online

- Low Income

- Age Eligibility, etc.

Read More: Aadhar Centre Registration: How To Apply for New Aadhar Centre

HDFC credit card customer care number

1800 202 6161 / 1860 267 6161

Now you can get access to your Bank Accounts, Credit Cards, Loans, and debit account services over the call.

The Banking Guides Official Social Media

| Click here | |

| Click here | |

| Click here | |

| Click here | |

| Quora | Click here |

| Official website | Click here |

Conclusion

In conclusion, applying for an HDFC credit card online is a convenient and efficient option for individuals who are looking to get a credit card from this reputable bank. The online application process is simple and can be completed in just a few steps, making it a quick and hassle-free way to apply for a credit card.

Additionally, there is a wide range of credit cards available to choose from, with different features and benefits to suit different needs and preferences. Overall, applying for an HDFC credit card online is a smart choice for anyone looking to get a credit card and take advantage of the many benefits it offers.

People Also Ask

How can I apply for an HDFC Bank credit card online?

To apply for an HDFC Bank credit card online, follow these steps:

- Go to the HDFC Bank website.

- Click on the “Credit Card” page.

- Select the credit card category that best fits your needs.

- Click on “Apply Now” for the credit card you want to order.

- Fill in the application form by entering the required information.

- Click “Submit” and wait for a decision on your application.

What documents do I need to apply for an HDFC Bank credit card?

To apply for an HDFC Bank credit card, you may need to provide the following documents:

- Proof of identity (e.g. PAN card, driver’s license, voter ID)

- Proof of address (e.g. utility bill, rent agreement)

- Proof of income (e.g. salary slips, bank statements)

- Recent passport-sized photographs

What is the process for tracking my credit card application?

To track your credit card application, follow these steps:

- Go to the HDFC Bank website.

- Click on the “Credit Card” page.

- Select the “Track Application” option.

- Enter your application number/reference number.

- Click on the “Track” button to view the status of your application.

Why was my credit card application rejected?

There are several reasons why your credit card application may be rejected, including:

- Insufficient income or poor credit history

- Incomplete or incorrect documentation

- Existing debt or unpaid bills

- Age restrictions (e.g. minimum age requirement not met)

how to apply for hdfc credit card?

To apply for an HDFC credit card, you can follow these steps:

- Visit the HDFC Bank website and go to the credit card section.

- Browse through the different types of credit cards offered by HDFC and select the one that suits your needs.

- Click on the “Apply Now” button to begin the application process.

- Fill in your details such as name, address, email address, phone number, and PAN card number.

- Provide your employment and income details.

- Choose the type of credit card you want and apply.

- HDFC Bank will review your application and may contact you for further details or documents if needed.

- If your application is approved, you will receive your credit card within a few days.

how do apply for an HDFC credit card?

To apply for an HDFC credit card, follow these steps:

- Visit the HDFC Bank website and go to the credit card section.

- Browse through the various types of credit cards that HDFC offers, and select the one that meets your requirements.

- Click on the “Apply Now” button to start the application process.

- Fill in your personal information, such as your name, address, email address, phone number, and PAN card number.

- Provide your employment and income details.

- Select the type of credit card you want and apply.

- HDFC Bank will review your application and may contact you for further details or documents if required.

- If your application is approved, you will receive your credit card within a few days.

Alternatively, you can also apply for an HDFC credit card by visiting an HDFC Bank branch and submitting your application in person. Make sure to carry all the necessary documents, such as ID proof, address proof, and income proof.

how to Apply for a credit card in HDFC?

To apply for a credit card in HDFC Bank, follow these steps:

- Visit the HDFC Bank website and go to the credit card section.

- Browse through the different types of credit cards offered by HDFC Bank and choose the one that suits your needs.

- Click on the “Apply Now” button to start the application process.

- Fill in your details such as name, address, email address, phone number, and PAN card number.

- Provide your employment and income details.

- Select the type of credit card you want and apply.

- HDFC Bank will review your application and may contact you for further details or documents if required.

- If your application is approved, you will receive your credit card within a few days.

how to apply for a credit card from HDFC Bank?

To apply for a credit card with HDFC Bank, follow these steps:

- Visit the HDFC Bank website and navigate to the credit card section.

- Browse through the various types of credit cards that HDFC Bank offers and choose the one that meets your requirements.

- Click on the “Apply Now” button to begin the application process.

- Fill in your personal information, such as your name, address, email address, phone number, and PAN card number.

- Provide your employment and income details.

- Choose the type of credit card you want and apply.

- HDFC Bank will review your application and may contact you for further details or documents if required.

- If your application is approved, you will receive your credit card within a few days.

how to apply for a credit card HDFC?

To apply for an HDFC Bank credit card, you can follow these steps:

- Go to the HDFC Bank website and navigate to the credit card section.

- Browse through the different types of credit cards available and select the one that suits your needs.

- Click on the “Apply Now” button to start the application process.

- Fill in your personal information, such as name, address, email address, phone number, and PAN card number.

- Provide your employment and income details.

- Choose the type of credit card you want and apply.

- HDFC Bank will review your application and may contact you for further details or documents if required.

- If your application is approved, you will receive your credit card within a few days.

how to apply for a credit card in HDFC bank?

To apply for an HDFC Bank credit card, follow these steps:

- Visit the HDFC Bank website and go to the credit card section.

- Browse through the various types of credit cards offered by HDFC Bank and select the one that suits your needs.

- Click on the “Apply Now” button to begin the application process.

- Fill in your personal information, such as your name, address, email address, phone number, and PAN card number.

- Provide your employment and income details.

- Choose the type of credit card you want and apply.

- HDFC Bank will review your application and may contact you for further details or documents if required.

- If your application is approved, you will receive your credit card within a few days.

how to apply for an HDFC credit card online?

To apply for an HDFC credit card online, follow these steps:

- Go to the HDFC Bank website and navigate to the credit card section.

- Browse through the different types of credit cards available and choose the one that suits your needs.

- Click on the “Apply Now” button to start the online application process.

- Fill in your personal information, such as your name, address, email address, phone number, and PAN card number.

- Provide your employment and income details.

- Select the type of credit card you want and apply.

- HDFC Bank will review your application and may contact you for further details or documents if required.

- If your application is approved, you will receive your credit card within a few days.

Note: Friends, we bring here the information about the scheme of the Central and State governments for you. So, you can save this website thebankingguides.com in your bookmarks. By clicking the link from above, you can connect to our all social media platforms.

If you like this article then share it with your friends and family.

Thanks for reading this article till the end.

3 thoughts on “HDFC Credit Card: Apply Online for Exclusive Benefits”

Comments are closed.